The Islamic banking industry in Malaysia is paving the way for a new phase of development. Why riba is condemned.

Pdf Emerging Issues In Islamic Banking Finance Challenges And Solutions

The Islamic Development Bank raised US15 billion with its first ever sustainable sukuk to help in the recovery from Covid-19 of its member countries he said.

. Iwadand lawful profits in Islam 29 Six. Realising the need to explore new opportunities to bring Islamic finance to the next level Malaysia has recently introduced value-based intermediation VBI principles. Shariand Tabi Principles 25 Five.

Islamic Financial System 19 Four. Malaysia issues RM25 billion US5687 million Malaysian Islamic Treasury Bill UAE. In Malaysia the utilisation of philanthropic Islamic social finance instruments such as zakat and waqf seems to be restricted because of regulatory hurdles.

Money and the Law ofDepreciation 45 Ten. With these features of the Islamic banks the following issues arise 1. Islamic financial system encourages risk-sharing financial contracts which implicitly favor.

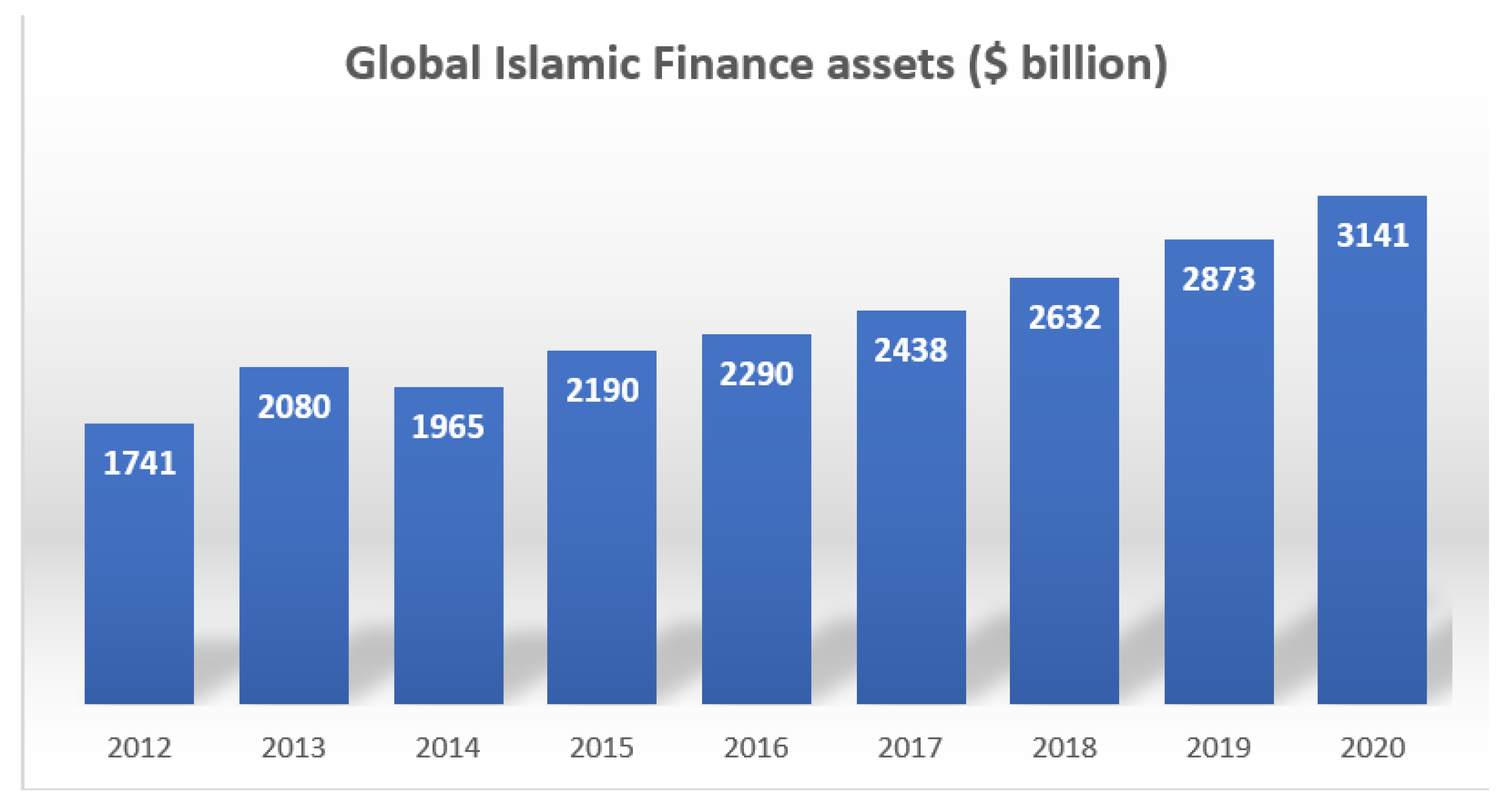

35 with Islamic financing contributing nearly all of the banking sectors growth in 2020 driven by household financing and banks that promoted Islamic products as part of the Islamic First strategy. This introductory article of the special issue Islamic Banking and Finance II highlights various studies on fast-growing Islamic finance industry. The Islamic finance industry in Malaysia is characterised by having comprehensive market components ranging from Islamic banking takaful Islamic money market and Islamic capital market.

7 Bank Islam Malaysia Malaysia 3969 554 8 Bank Muamalat Malaysia Malaysia 3813 202. Riba and Interest 33 Seven. Tools to Attract Depositors The Islamic banks so far have undertaken extensive research in devising non-usurious procedures to utilize their funds.

Islam and Time Value ofMoney 41 Nine. It has tremendous potential to grow further in. Malaysia has recorded 173 growth of Islamic finances market between 2009 -2014 MIFC 2015 a.

Proponents such as Zeti Akhtar Aziz the head of the central bank of Malaysia have argued that Islamic financial institutions are more stable than conventional banks because they forbid speculation and their two main types banking accounts current account and mudarabah accounts carry less risk to the bank. The data from the above table reveals that an overwhelming 556 n 40 of respondents strongly agreed on their understanding about islamic banking and finance and 181 n13 agreed. International Institute of Advanced Islamic Studies.

Islamic Finance and Modern Economy 1. The role of. Malaysia was named a leader in Islamic finance producing 26 of the worlds Shariah-compliant financial assets by the end of 2017amounting to US5287 billion RM205 trillion.

Main Principles of IF A Complete ban on Riba or Usury Traditionally complete ban on interest based financial activities Charging interest is immoral it gives steady payment to the lender regardless of the financial situation of the market and the borrower one way traffic. The 14 of n1 disagreed with their knowledge about islamic banking and finance while 25 n18 answered none to the. The study proclaimed Asia as the largest market for both sukuk and Islamic funds.

Trading of Debt Bai Al-Dayn is a combination of Bai Sale and Dayn which is referred to as Debt. Current Issues The Shariah Perspective. MALAYSIAs Islamic finance penetration rate has grown steadily over the years and looks on track to reach the central banks target of 40 share of total financing by the end of 2020 notwithstanding the disruptions from the Covid-19 pandemic.

Most of the literature studies and reports basically mentioned on the general issues and challenges such as political risk legal risk currency and. Setia Fontaines prints unrated Islamic medium-term note worth RM8 million US182 million MALAYSIA. He said instruments such as social sukuk could help support the education and health care system as well as attract environmental social and governance investing.

Shariah Issues in Islamic Finance 10 f Syed Salman 1300218 32 Bai Al-Dayn 3211 1st Issue. The current practice in Islamic insurance is a theoretical division of returns and an uneven and unstandardized distribution between participants and investors. The share of Islamic financing in the banking system reached 37 by end-2020 end-2019.

In order to validate reliability and feasibility of the proposed model a focus group discussion was conducted to ascertain its relevance in the Islamic insurance industry. It focuses specifically on Islamic banking and Islamic capital market research. Riba AI-Bayand Risks Ghorm 37 Eight.

Death Penalty in Malaysia. Governance issues are equally important for Islamic banks investors regulators and other stakeholders. The phenomenal worldwide development over the past decade of Islamic banking and finance is drawing much attention to Southeast Asia which on the platform of its own economic growth success is also proving to be the gateway for Middle Eastern petrodollar investments into the two great emerging markets of India and China.

Fri 3 June 2022 11am Malay. Very little research has been done in. The data in the Economic Outlook 2021 report published by the Finance Ministry MoF shows that the Islamic banking industry in Malaysia has expanded with.

But when it comes to the tech side of Islamic fintech the picture is not quite so clear-cut. A comprehensive market infrastructure and a robust and progressive regulatory framework are already in place. This is due to the fact that both zakah and waqf fall explicitly within the exclusive jurisdiction of the states.

First Abu Dhabi Bank launches new sustainable current account enabling corporate clients to contribute to sustainable development. The Islamic Worldview 13 Three. IslamicEventsMY is YOUR one-vastop portal for Islamic events religious knowledge classes and courses Halal Food and Musollah locations all around Malaysia.

According to RAM Ratings Malaysia was the top sukuk issuer with US139 bil ringgit equivalent or 351 of the US395 bil ringgit equivalent sukuk issued. Bai Al-Dayn is also referred as Bai Al-Kali Bil-Kali or Bai Al-Dayn Bil-Dayn. Bank Negara Malaysia in its Financial Sector Blueprint 2011-2020 released in December 2011 said it expected financing.

Development Of The Malaysian Islamic Financial System

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Pdf Islamic Finance Operational Transaction Framework A New Insight Of Islamic Finance Implementation In Malaysia And Japan

Leveraging Islamic Fintech To Improve Financial Inclusion

The Impact Of Monetary Policy On Islamic Bank Financing Bank Level Evidence From Malaysia

Joitmc Free Full Text Exploring The Role Of Islamic Fintech In Combating The Aftershocks Of Covid 19 The Open Social Innovation Of The Islamic Financial System Html

Connecting Malaysia S Islamic And Sustainable Finance To The World

The Leading Source Of Information On Halal Industries Islamic Finance Islamic Lifestyle News Companies Insights Reports Announceme Economy Islam Global

Ta05346 Finance Islam Financial

Pdf Islamic Banking In Malaysia A Study Of Attitudinal Differences Of Malaysian Customers

Pdf Factors Influence Switching Behavior Of Islamic Bank Customers In Malaysia

Pdf Trends And Challenges In Islamic Finance

Pdf The Global Perspective Of Islamic Finance And The Potential For China To Tap Into The Islamic Finance Market

New Arrivals Ptar Vol 8 February 2020 Arrivals Library February

List Of Islamic Banking Institutions In Malaysia Download Table